|

Take Charge

It's possible to meet your financial

goals - whether your income is small, medium or large.

By looking for good information on managing

your finances, along with choosing to budget, save and use credit wisely,

you can:

- Buy a home.

- Send your child to college.

- Start a business.

- Pay off debts.

- Put money away for a rainy day.

- Save for retirement.

No matter who you are, you can take

charge of your financial future. Start today!

To get you started, here are some simple

tips.

Set Goals

Most people who have money didn't get

it overnight. They set goals and worked hard to reach them.

TRY THIS: Write down your short-term

and long-term goals. An example of a short-term goal is saving up for

holiday gifts; a long-term goal is saving for a home.

- Set due dates for reaching your goals.

- Be realistic.

- Be flexible. (It's OK to adjust your

goals and strategies.)

- Go back and look at your goals after

six months to check your progress.

Develop

a Budget

Find

out where your money is going. Unless you're tracking your money, it's

probably not going where you really want it to.

TRY THIS: Write down your total

monthly take-home pay. Then list your monthly expenses. At the end of

the month, subtract those expenses from your total pay.

- Look for places to save.

- Use this information to set a monthly

budget that includes saving.

- Review how things are going each

month.

TIP:

Carry a small notebook. Write down everything you spend. Include small

things like candy bars.

Start Saving

Small

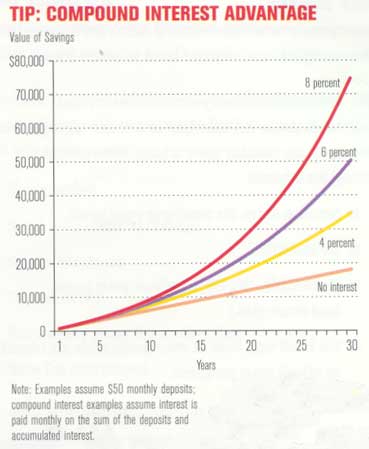

amounts of money saved regularly add up fast. Compound interest, which

lets you earn interest on interest, will make your savings grow even faster.

TRY THIS: Open a savings account.

Have part of your paycheck deposited directly into your savings account

every month.

- Shop for the best interest rates.

- Understand all fees and charges.

- Take advantage of your company's

401 (k) or invest in an IRA (individual retirement account).

- As your income rises, increase the

percentage you save.

- Know that the greater the potential

profit on an investment, the greater the potential risk of losing your

money.

TIP:

The earlier in life you start saving, the more you'll have later.

Manage Credit

Wisely

Borrowing can help you meet your long-term

goals for an education, car or home. But borrowing for day-to-day needs

and wants gets many people into financial trouble.

TRY THIS: Before using your credit

card, getting a payday loan, renting-to-own or borrowing against your

home's equity, ask yourself if you really need to borrow the money.

- Avoid spur-of-the-moment purchases.

- Set a monthly limit on credit card

charges.

- Pay more than the minimum on your

credit card bill.

TIP: THE MINIMUM

PAYMENT TRAP

It would take 61 years to pay off a $5,000 credit card balance if you

make only the minimum monthly payment. You would pay almost $16,000* in

interest!

* Assuming a 14% interest rate

and minimum payment of 1.5% of the outstanding balance.

Protect

Your Credit Rating

Lenders use credit reports to decide

whether to loan money. Insurance companies, landlords and employers also

check credit reports. A report that shows defaults or late payments- even

30 days late-can mean not getting a loan or paying a higher interest rate.

TRY THIS: Find out your credit

rating. Call a credit bureau for a copy of your report.

- Pay all bills on time.

- If you're having trouble paying bills,

get advice from a reputable nonprofit organization before you become

delinquent.

- Check your credit report every year.

- Alert the credit bureau if you see

errors in your report.

TIP: CREDIT BUREAUS

Equifax 1-800-685-1111

Experian 1-888-397-3742

Trans Union 1-800-888-4213

Get the

Best Deal

When you borrow money, you have a right

and a responsibility to know all the loan's terms and conditions. Ask

questions and compare interest rates and fees. Know what's at stake if

you don't make your payments.

TRY THIS: Before you borrow money,

ask these questions:

- What is the interest rate?

- What are all the fees?

- How much will I have paid in interest

when the loan is paid off?

- Can I pay it off early without penalty?

AND THIS: Shop around and compare.

Don't get taken.

- Question an offer that makes borrowing

sound too good to be true.

- Always read and understand the fine

print.

- Seek help if you need it.

TIP: SAVE MONEY WITH

THE RIGHT LOAN

Get

the Lowest Rate

| $15,000

Car Loan for 5 Years |

| Lender |

Interest rate

|

Total interest

|

| Pixley Bank |

6.5%

|

$ 2,609.53

|

| ABC Car loan |

7.5%

|

$ 3,034.15

|

| XYZ Finance Company |

8.75%

|

$ 3,573.51

|

Choose

the Shortest Term

| $15,000

Car Loan at 10 Percent Interest |

| |

3-year

|

4-year

|

5-year

|

| Number of payments |

36

|

48

|

60

|

| Payment |

$ 484

|

$ 380

|

$ 318

|

| Total paid |

$ 17,424

|

$ 18,261

|

$ 19,122

|

| Interest saved |

$ 1,698

|

$ 861

|

$0

|

Take Control

Getting the right information can help

you gain control of your finances.

TRY THIS: When you need information,

make sure the source is reliable.

- Know who you are dealing with.

- Make sure the resource is credible

and properly trained, accredited or certified.

- Ask for references.

- Understand any fees or charges.

- Make sure they're not trying to sell

a product or service.

- Avoid resources that charge excessive

fees.

- Ask questions.

Learn More

About Money

TRY THIS: Look for organizations

in your community that can help you learn more about setting financial

goals, budgeting, saving, using credit wisely and getting the best deal.

Here are some possibilities:

- Nonprofit credit counseling service

- Library

- Community college

- Bank or credit union

- Nonprofit community development corporation

- Nonprofit housing organization

- Religious organization

- Senior citizen center

- Employee assistance program

- Cooperative extension service

|